Riding the Policy Wave: How Pytes Wins in Volatile Markets Through the Australian Energy Storage Boom

Introduction

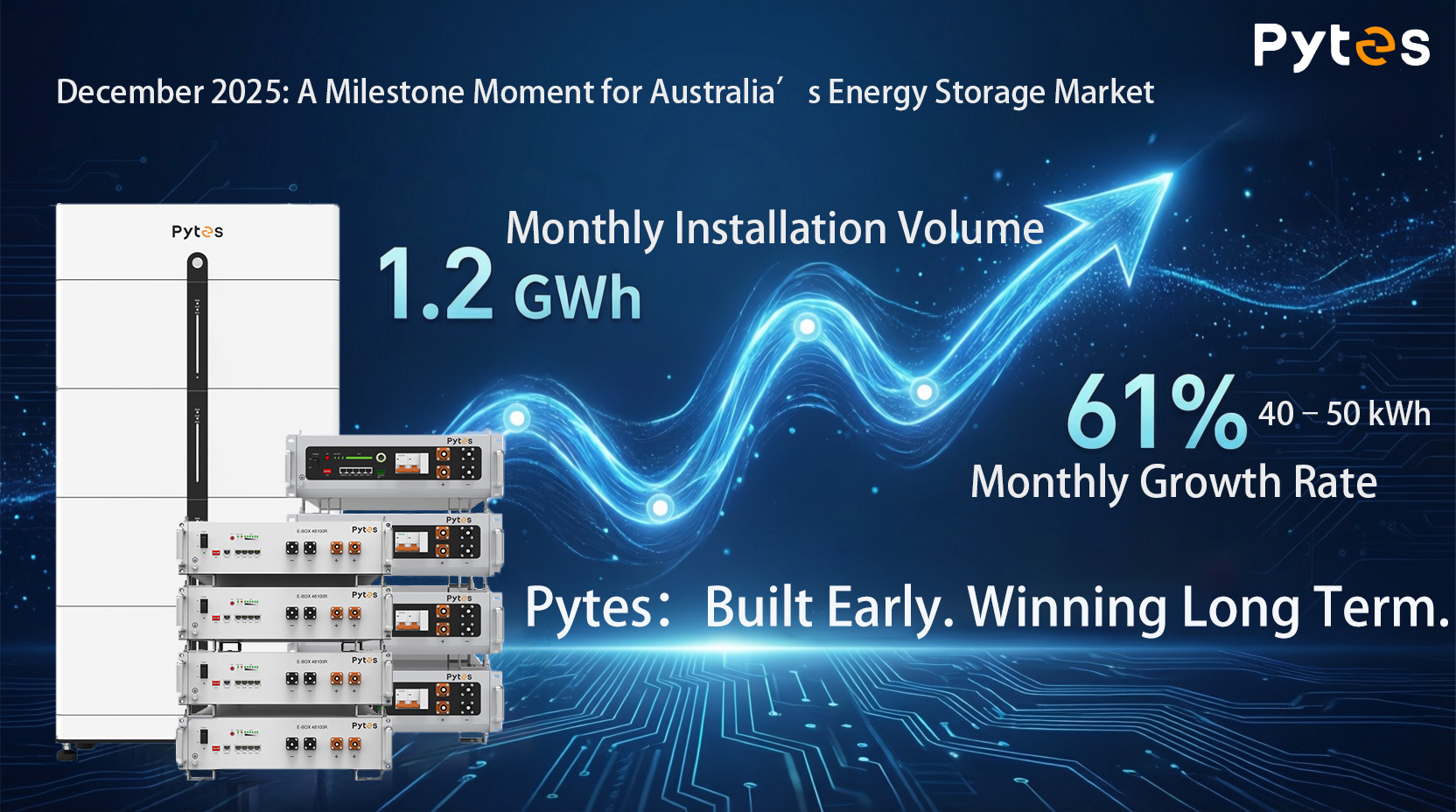

In December 2025, Australia’s energy storage market reached a historic milestone, with behind-the-meter installations exceeding 1.2 GWh in a single month for the second consecutive time. Yet the true signal lies not in scale alone, but in a rapid structural shift: average system sizes moved sharply upward, the 40–50 kWh segment surged by 61% month-on-month, and demand for small systems declined noticeably.

This transformation was anything but accidental. It was the market’s direct response to policy signals. Following the Australian federal government’s announcement that incentives for systems above 14 kWh would be reduced starting in May 2026, the market entered a classic “last-chance subsidy” phase. Demand became concentrated, specifications standardized, and risk tolerance sharply diminished. For policy-driven markets, the lesson is clear: true competitive advantage is built before the window opens, not during the rush itself.

Policy windows test suppliers on three critical dimensions: compliance, availability, and suitability. When incentives peak, the market no longer asks what suppliers can do in the future—it asks what they can deliver now, with certainty.

Pytes’ Australian strategy was established well ahead of the policy surge. Rather than chasing the window, Pytes was already in position when it opened.

Compliance came first.

Australian regulatory requirements were embedded at the product-design stage. Core products including V5°α Plus, Pi LV1, and E-BOX-48100R have completed CEC listing, ensuring smooth approval and installation during the most time-sensitive deployment cycles.

Localization followed.

Pytes plans to complete the launch of its Australian subsidiary in Q1 2026, alongside the build-out of local technical support, installer training, and after-sales service. This allows the company to respond to market needs with local speed and perspective, rather than remote supply-chain coordination.The dedicated Pytes Australia website (Pytes AU) is also set to go live, serving as a centralized platform for product information, technical resources, and local partner support.

Ecosystem partnerships strengthened execution.

To address the window-period preference for larger, immediately available systems, Pytes introduced a warehouse-partner program in Australia, developing deep inventory collaboration with installers focused on commercial and industrial storage projects—ensuring delivery certainty at peak demand.

Product architecture closed the loop.

Standardized, plug-and-play energy storage systems significantly reduce installation time while enabling modular expansion, aligning precisely with shifting subsidy thresholds. Across the portfolio, systems can be flexibly scaled—from Pi LV1 configurations up to 245.76 kWh, to V5°α Plus and E-BOX-48100R deployments reaching 491.52 kWh—allowing installers and homeowners to right-size capacity to meet policy requirements while capitalizing on the market’s accelerating shift toward higher-capacity installations.

In addition, Pytes plans to introduce the V14 (14 kWh) system next year, specifically designed for Australia’s more affordable home battery incentive scheme—further reinforcing its commitment to accessible, high-value residential storage solutions.

Australia is not an exception. Similar policy-window dynamics have emerged globally: residential installations surged in Germany ahead of subsidy reductions, commercial storage applications tripled in Italy following new incentive announcements, and large-scale storage development accelerated in the UK during capacity-market adjustments.

Drawing from these patterns, Pytes has institutionalized policy-window readiness into a three-tier global response framework:

lBaseline markets: Standard products with core certifications

lPre-policy markets: Pre-certified products and local inventory buildup

lActive window markets: Fully certified portfolios, local technical support, and accelerated delivery channels

Rapid growth in energy storage inevitably coincides with evolving policy frameworks. Australia’s 2025–2026 subsidy transition once again demonstrates how policy shapes demand—and filters market participants.

At Pytes, preparation itself is a strategic advantage. Through forward-looking certification, localized infrastructure, and policy-aligned product planning, we deliver more than hardware—we deliver certainty in volatile markets. Australia today may well be another market’s tomorrow. Those who prepare early will lead the next policy wave, rather than chase it.